Experiencing a major pullback in stocks is never a comfortable feeling. In times like these, we believe it can be helpful to set aside the daily headlines and keep perspective of how stocks have historically performed over the long term. After all, the majority of market participants are long-term investors, not day traders as the financial media would have its viewers believe.

Investors whose portfolios contain high-quality fixed income and equity positions have almost certainly seen their fixed income allocations benefit greatly in recent months, as their equity positions have suffered. Given the most recent market, equity allocations are likely below their portfolio targets and fixed income allocations are likely above their portfolio targets. Now might be an opportune time for some investors to adjust those portfolio allocations back to their long-term targets and potentially capture benefits from rebalancing.

The recent market volatility presents an opportunity for investors to assess their current portfolios based on their long-term financial goals. For many investors with a long-term investment horizon, this could be an appropriate time to consider adding equity investments to their portfolio if the equity allocation is below its target.

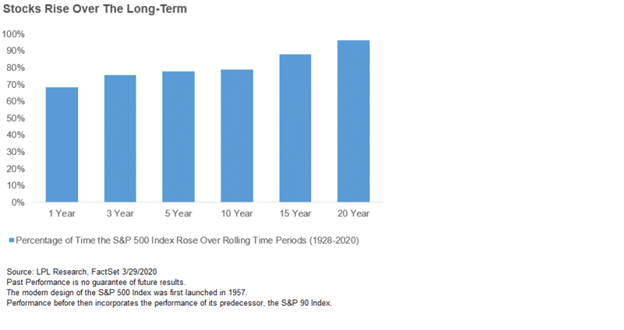

Short-term volatility comes in waves, but stocks have an extremely attractive track record over the long term. As shown in the following chart provided by LPL Financial, over all rolling periods since 1928, stocks have risen 76% of the time across a three-year horizon, and that percentage rises to 96% when zooming out over a 20-year horizon. When starting from levels as depressed as the current market prices are, the risk/reward tradeoff is even more appealing.

All indexes are unmanaged and cannot be invested into directly.

While past performance is no guarantee of future results, we do view history as a helpful guide for future possibilities. We take comfort in the fact that the data sets are as positive as they are despite weathering such volatile periods as the Great Depression and the Financial Crisis.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.